Amended Tax Return 2025. For turbotax live full service, your tax expert will amend your 2025 tax return for you through november 15, 2025; To complete your financial aid file, you and your spouse's (if married) amended 2025 federal tax return must be verified.

Where’s my amended return will show your amended return status for this tax year or up to 3 prior years. Deadlines for paying tax you owe

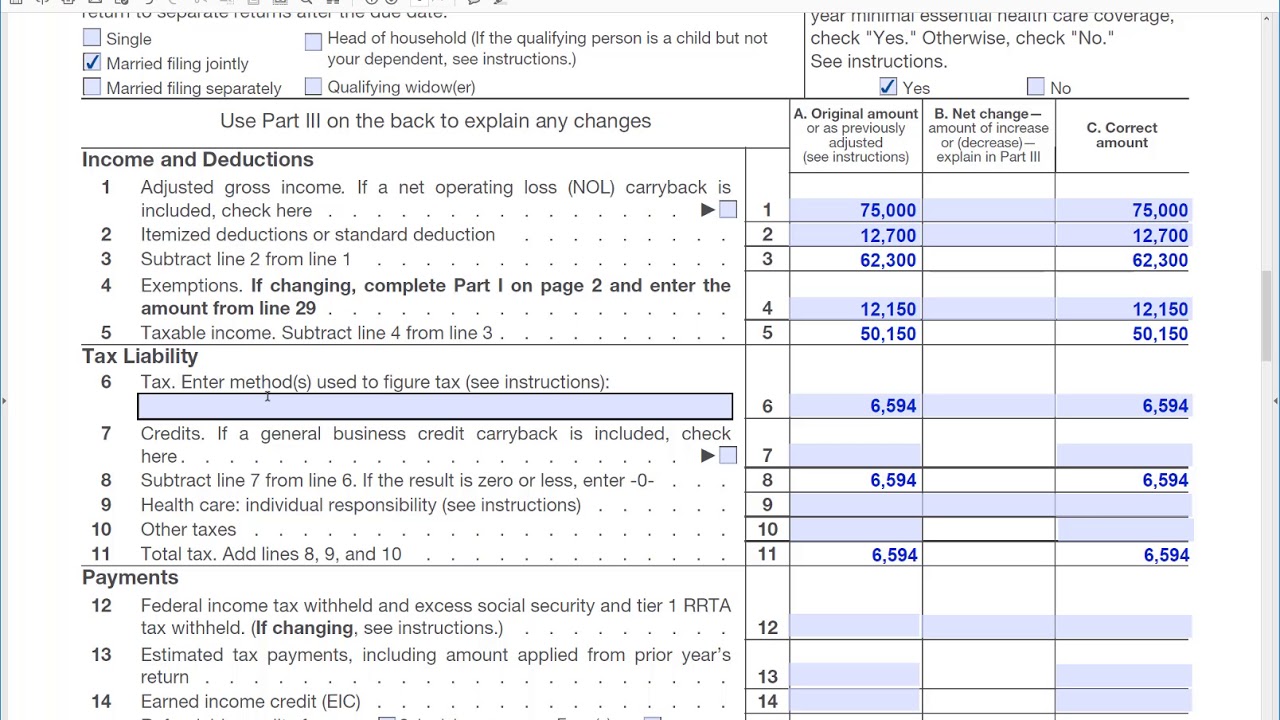

How to fill out Form 1040X, Amended Tax Return YouTube, It’s not uncommon to make a mistake on your federal tax return or leave out important information.

How to file an amended tax return WTOP News, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

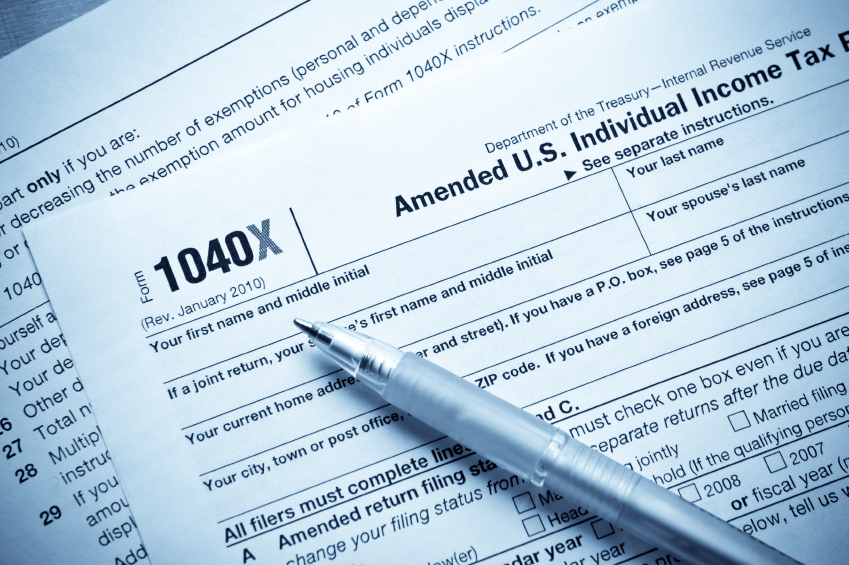

1040X Amended Tax Return, Once you’ve been notified by the irs that they have received and accepted your original return for 2025, then you can amend your.

Amended tax return r/IRS, You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return.

Everything You Need To Know About Amended Tax Return Tax help, Tax, In order to make changes, corrections, or add information to an income tax return that has been filed and accepted by the irs or state tax agency, you must file a tax amendment to correct your return(s).

Filing an Amended Tax Return Wheeler Accountants, With h&r block, you can file an amended tax return online.

Amended tax return r/IRS, You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return.

Correcting Mistakes After You File Amended Tax Returns, After that date, turbotax live full service customers will be able to.

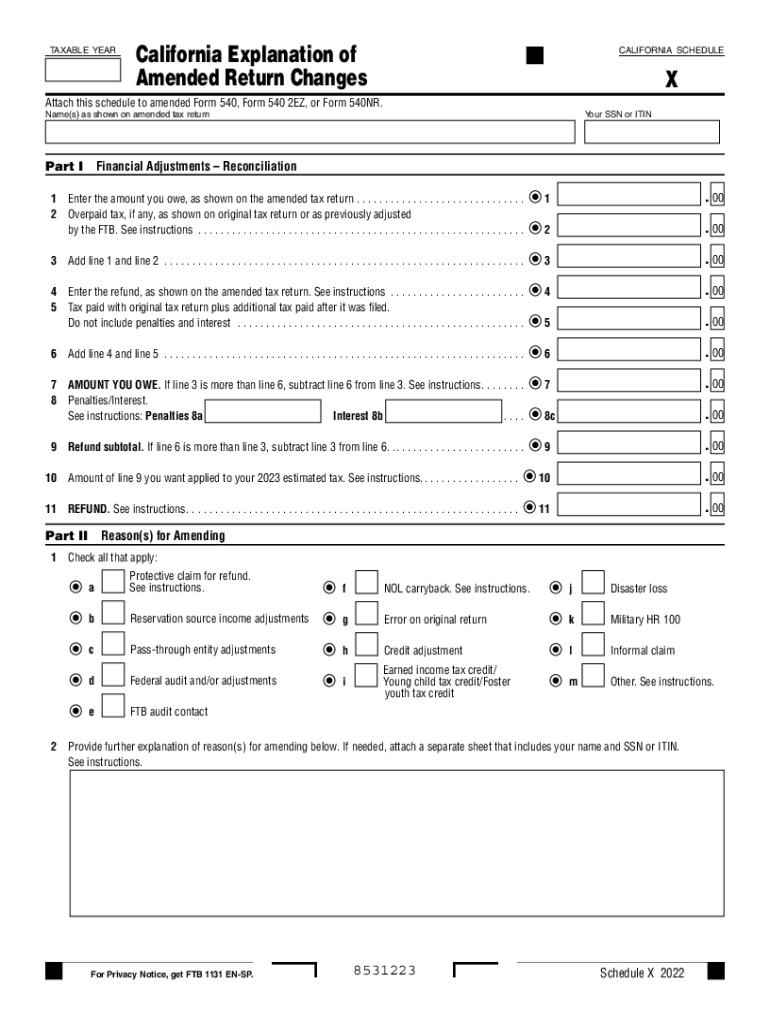

California amended tax return form Fill out & sign online DocHub, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables.

How Long Does An Amended Tax Return Refund Take? Digest Your Finances, You can claim a refund by filing an amended return within three years from the original filing date or two years from the date you paid the tax owed, whichever is later.