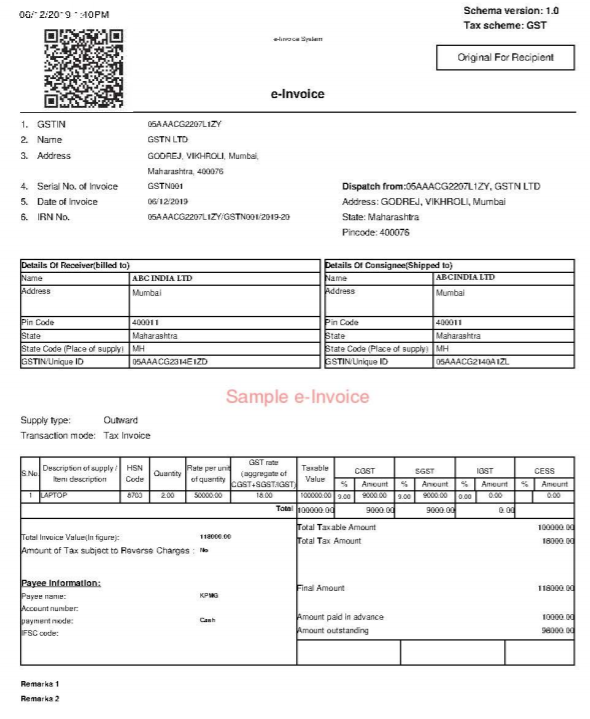

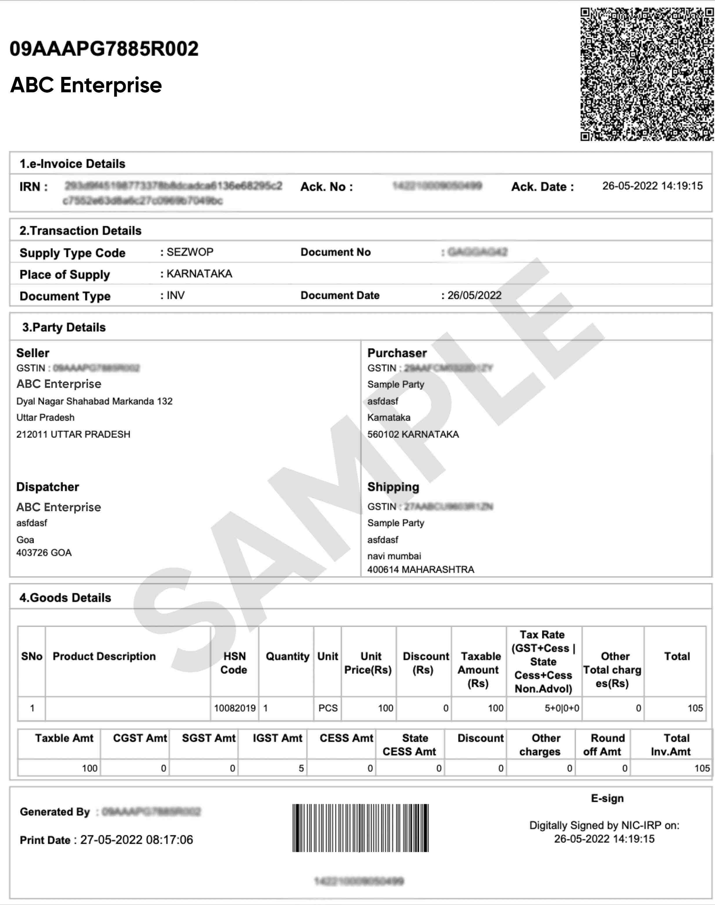

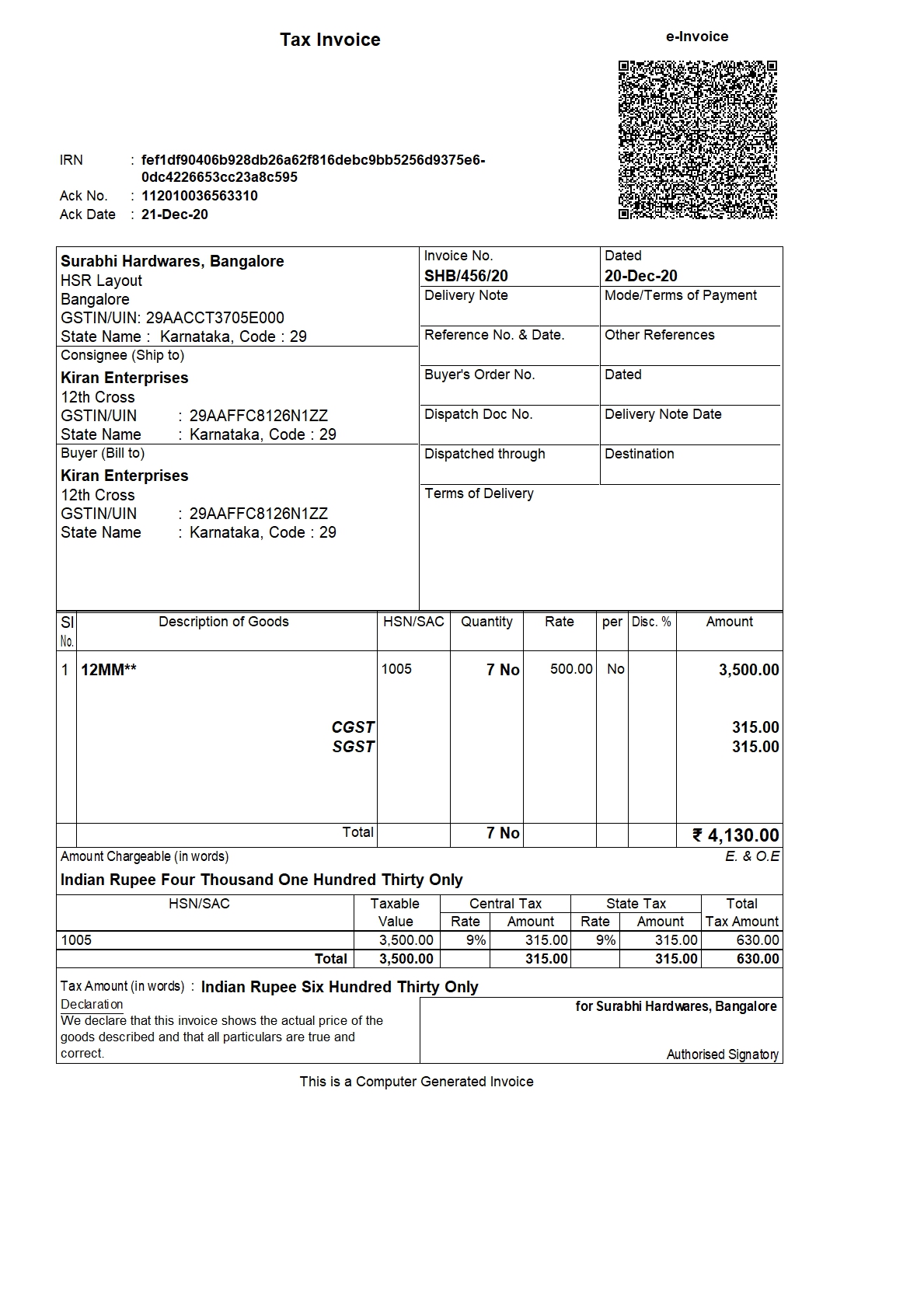

E Invoice Turnover Limit 2025-25. It includes the latest update on the 10th of may 2025 about the turnover limit being reduced from 10 crores to 5 crores. E invoices are mandatory for businesses with aggregate annual turnover (aato) between rs.5 crore and rs.10 crore from 1st august 2025.

E Invoice Turnover Limit 202425 Ardith Gwendolin, This calculator makes it easy for you to determine if you qualify for e.

E Invoice Turnover Limit 202425 Ardith Gwendolin, Learn more about this rule, who should comply, start.

New Turnover Limit for e invoicing from 1st Aug 2025 GST E INVOICE TURNOVER Limit By CA, Cbic announces a further reduction in the aggregate turnover threshold limit, from rs 10 crore to rs 5 crore, for 'e invoicing' of b2b transactions, effective 01/08/2025.

e Invoice Limit 2025 Mandatory eInvoice for above 5 Crore Turnover myBillBook YouTube, This calculator makes it easy for you to determine if you qualify for e.

eInvoice Limit mandatory for business above Rs.5 crore turnover, The gst network has asked its technology providers to.